U.S. Healthcare IT Software Market

U.S. Healthcare IT Software Market Trends

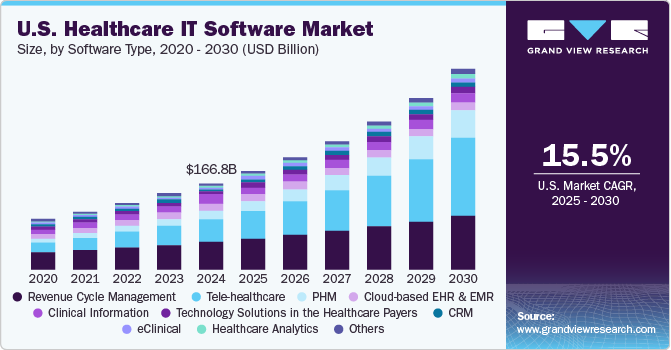

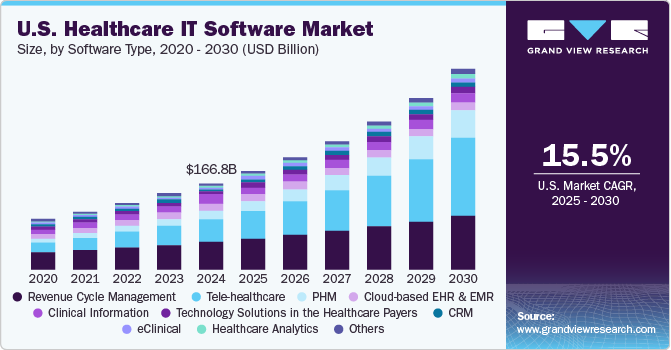

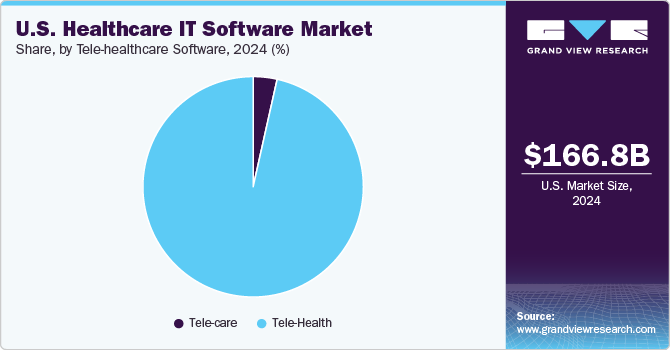

The U.S. healthcare IT software market size was estimated at USD 166.83 billion in 2024 and is projected to grow at a CAGR of 15.46% from 2025 to 2030. The increasing adoption of electronic health records (EHR) and electronic medical records (EMR), fueled by federal mandates and initiatives like the HITECH Act, has significantly expanded the market. Rising demand for interoperability, a shift towards value-based care, and population health management have further accelerated the adoption of healthcare analytics software. In addition, emerging technologies such as artificial intelligence (AI) and machine learning are being integrated into diagnostic tools, patient management systems, and administrative processes, further fueling growth.

Increasing technological advancements in healthcare owing to rising R&D in medicine are anticipated to fuel the demand for laboratory information software. Increasing adoption of laboratory information software in hospitals, pathology & diagnostic centers, and research labs due to its growing application scope for patient engagement, workflow management, billing, patient health information tracking, and quality assurance is expected to drive the segment growth. For instance, in November 2023, Thermo Fisher Scientific Inc. partnered with Flagship pioneering to develop and expand multiproduct platforms, create new platform companies focusing on innovative biotech tools & capabilities, and broaden their existing supply relationship across life science tools, diagnostics, & services.

Moreover, increasing adoption of e-consent in clinical trials, integration of e-consent with other clinical solutions, and growing acquisition & partnership deals by key market players are additional factors contributing to market growth. Companies that acquire or form strategic partnerships with eConsent solution providers and other eClinical companies are expected to gain a competitive advantage across various sectors. For instance, in June 2022, uMotif and ClinOne announced a partnership to address the challenges faced by patients & clinical research coordinators who struggle to navigate multiple systems, apps, & sensors for each protocol. To overcome these challenges, the two companies aim to provide the life sciences industry with a single, integrated solution that delivers best-in-class eCOA and eConsent technology.

Furthermore, the market experiences lucrative growth with new product launches, mergers and acquisitions, and collaboration activities. The following are some of the recent strategic initiatives by key market players. For instance, in September 2024, ContinuumCloud partnered with DrFirst to improve medication management for behavioral health providers. This collaboration integrates DrFirst’s medication management solutions into ContinuumCloud’s Welligent EHR platform to enhance prescribing workflow with features like comprehensive medication history, clinical alerts, and Electronic Prescribing for Controlled Substances (EPCS).

“We’re pleased to collaborate with ContinuumCloud to perfect the prescribing process for behavioral health providers,”

“Their thoughtful integration of our medication management solutions into the EHR create efficient and easy-to-use prescription workflows and safety, freeing up time for what matters most—patient care.”

– G. Cameron Deemer, CEO of DrFirst.

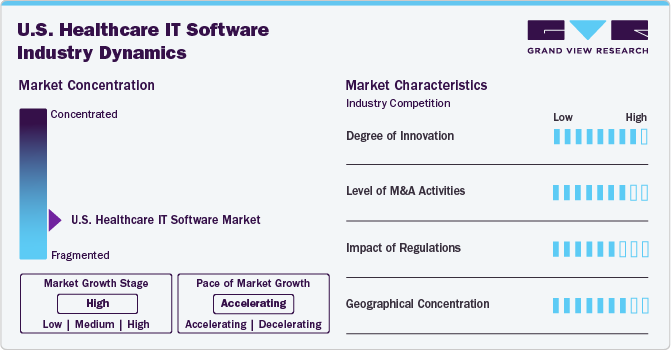

The degree of innovation in the U.S. healthcare IT software industry is high. Technological advancements such as cloud-based platforms enhance data accessibility, security, and interoperability across healthcare providers. Moreover, artificial intelligence (AI) integration for healthcare analytics, personalized medicine, and decision support systems further drives the market growth.

For instance, in January 2024, Hyperfine Inc. introduced a new AI-powered software designed for the Swoop system to enhance the quality and usability of brain imaging. This innovative software aims to improve the diagnostic capabilities of its portable MRI system, making brain imaging more accessible and efficient for healthcare providers.

“Our latest AI-powered software, the eighth generation of our proprietary software platform, embodies our commitment to supporting clinicians in critical decision-making,”

“Our focus on image quality with this latest software has been on the DWI sequence, which is key in stroke imaging. Since its first FDA clearance in 2020, we’ve been dedicated to continually enhancing image quality and workflow efficiencies to define best-in-class, user-centric, ultra-low field MR brain imaging.”

-Tom Teisseyre, PhD, Chief Operating Officer of Hyperfine, Inc.

Market Concentration & Characteristics

The level of M&A activities, such as mergers, acquisitions, and partnerships, is high, enabling companies to expand geographically, financially, and technologically. For instance, in May 2023, MultiPlan Corporation acquired Benefits Science, LLC, a healthcare data and analytics company. This strategic acquisition aims to enhance Multiplan’s capabilities in data-driven healthcare cost management by integrating Benefits Science’s analytics and AI-driven tools.

The regulatory framework for the U.S. healthcare IT software industry is shaped by various guidelines. The 21st Century Cures Act enhances the flow of electronic health information, promoting interoperability and prohibiting information blocking. In addition, the Health Information Technology for Economic and Clinical Health (HITECH) Act of 2009 empowers the Department of Health and Human Services to establish programs to improve healthcare quality, safety, and efficiency by promoting health IT, including electronic health records and secure information exchange. Moreover, the Affordable Care Act of 2010 also implements comprehensive healthcare reforms to increase access, improve quality, and reduce costs.

Geographical expansion drives growth in the U.S. healthcare IT software connectivity solutions market by broadening market reach and increasing adoption in emerging regions. It allows providers to address diverse healthcare needs and regulatory environments, fostering innovation and tailored solutions. For instance, in June 2024, Synthesis Health secured three multisite contracts, including Tahoe Carson Radiology in Carson City, Nevada; Naugatuck Valley Radiology in Prospect, Connecticut; and Intermountain Medical Imaging in Boise, Idaho, enhancing its presence in the healthcare imaging sector. These contracts are expected to expand the company’s reach and improve its service offerings across various healthcare facilities.

Software Type Insights

Based on software type, the revenue cycle management software segment led the market with the largest revenue share of 32.66% in 2024. The healthcare industry is rapidly moving toward digitalization, creating demand for advanced revenue cycle management (RCM) solutions. The growth of healthcare organizations is expected to be driven by the increasing demand for workflow optimization through the adoption of synchronized management software systems. The increasing number of data silos and unorganized workflows in healthcare settings is leading to market development & growth. RCM involves third-party payers, payment models, guidelines, and codes. Hence, healthcare organizations collaborate with market players to adopt RCM solutions, thereby contributing to market growth. For instance, in January 2024, Tallahassee Memorial HealthCare partnered with an RCM solutions provider, Ensemble Health, to enhance patient care.

The tele-healthcare software segment is expected to grow at the fastest CAGR over the forecast period. The increasing number of patients suffering from conditions requiring Long-term Care (LTC), including Alzheimer’s disease, cancer, diabetes, and cardiovascular diseases (CVDs), is one of the significant factors expected to drive the tele-healthcare software segment. The telehealth & telecare software is used for remote monitoring, medication management, and consulting of LTC patients.

For instance, according to the National Bureau of Economic Research, in November 2023, 30% of the population aged 65 or older and 60% of the population aged 85 or older have some limitations in conducting daily activities. In addition, the same report states that in 2019, more than 1.3% of total GDP was spent on LTC. LTC conditions are a major economic burden on hospitals & clinics, which is expected to drive the demand for tele-healthcare services for remote monitoring and physician consultation of LTC patients.

Key U.S. Healthcare IT Software Company Insight

The U.S. healthcare IT software industry is highly competitive, featuring a wide range of established players as well as emerging startups. With increasing demand for digital transformation in healthcare, competition is intensifying as companies focus on product development, partnerships, and acquisitions to enhance their market position. The market is also driven by advancements in artificial intelligence, big data, and machine learning, which are reshaping the landscape and encouraging both incumbent players and new entrants to adopt cutting-edge technologies to stay ahead of the competition. For instance, AGS Health’s AGS AI Platform (launched in September 2022) integrates AI and automation with human expertise to optimize RCM performance, offering productivity tracking, root cause analysis, and customizable dashboards

Key U.S. Healthcare IT Software Companies:

- Philips Healthcare

- McKesson Corporation

- eMDs, Inc.

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

- Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital)

- Carestream Health

- GE Healthcare

- Agfa- Gevaert Group

- Hewlett Packard Enterprise Development LP

- Novarad

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- SAP

- Accenture

Recent Developments

-

In November 2024, Suvoda received a patent for its Questionnaire Definition Language (SQDL), part of its electronic Clinical Outcome Assessment (eCOA) software. This innovation allows for rapid questionnaire design and deployment, significantly reducing the time required for clinical trial sponsors to launch studies.

-

In October 2024, Oracle launched the upgraded version of Clinical AI Agent, an advanced AI tool to streamline clinical workflows and enhance decision-making processes within healthcare settings.

-

In September 2024, ContinuumCloud partnered with DrFirst to improve medication management for behavioral health providers. This collaboration integrates DrFirst’s medication management solutions into ContinuumCloud’s Welligent EHR platform to enhance prescribing workflow with features like comprehensive medication history, clinical alerts, and Electronic Prescribing for Controlled Substances (EPCS).

-

In September 2024, LabWare and Mettler Toledo introduced a new software connector that integrates LabWare’s LIMS and Electronic Lab Notebook (ELN) with Mettler Toledo’s LabX software. This integration aims to enhance laboratory efficiency and connectivity.

-

In April 2024, Atlantic Health System announced the adoption of FeelBetter’s Precision Population Health Platform, aimed at optimizing and personalizing medication management for patients. This initiative is part of Atlantic Health’s commitment to improving patient care and health outcomes through innovative technology.

U.S. Healthcare IT Software Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 189.59 billion

|

|

Revenue forecast in 2030

|

USD 388.99 billion

|

|

Growth rate

|

CAGR of 15.46% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 – 2023

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Software Type

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Philips Healthcare; McKesson Corporation; eMDs, Inc.; Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital); Carestream Health; GE Healthcare; Agfa- Gevaert Group; Hewlett Packard Enterprise Development LP; Novarad, Optum, Inc.; IBM, Oracle; SAS Institute, Inc.; IQVIA; Verisk Analytics, Inc.; SAP; Accenture

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Healthcare IT Software Market Report Segmentation

This report forecasts revenue growth and provides country-level analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. healthcare IT software market report based on software type:

Frequently Asked Questions About This Report

b. The U.S. healthcare IT software market size was estimated at USD 166.83 billion in 2024 and is expected to reach USD 189.59 billion in 2025.

b. The U.S. healthcare IT software market is expected to grow at a compound annual growth rate of 15.46% from 2025 to 2030 to reach USD 388.99 billion by 2030.

b. Revenue cycle management software accounted for a majority share of 32.66% in the software type segment in 2024. This growth is driven by increasing healthcare digitization, AI integration, cost reduction needs, and the adoption of cloud-based solutions.

b. Some key players operating in the U.S. healthcare IT software market include Philips Healthcare, McKesson Corporation, eMDs, Inc., Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.), Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital), Carestream Health, GE Healthcare, Agfa- Gevaert Group, Hewlett Packard Enterprise Development LP, Novarad, Optum, Inc., IBM, Oracle, SAS Institute, Inc., IQVIA, Verisk Analytics, Inc., SAP, Accenture.

b. Key factors that are driving the market growth include the increasing digital transformation, rising demand for interoperability, AI-driven automation, cloud adoption, value-based care models, regulatory support, and the need for cost reduction, operational efficiency, and enhanced patient data management.

link