KKR in talks to buy stake in healthcare data analytics firm Cotiviti: WSJ

Dive Brief:

-

Private equity firm KKR is in talks to buy a 50% stake in healthcare data analytics firm Cotiviti from Veritas Capital, according to The Wall Street Journal.

-

The deal, which sources familiar said could be finalized in the coming weeks, would value the health technology company at about $11 billion. Veritas acquired Cotiviti in a take-private deal valued at $4.9 billion in 2018.

-

If the purchase is finalized, it would also rate among the largest U.S. private equity deals announced this year, according to the WSJ.

Dive Insight:

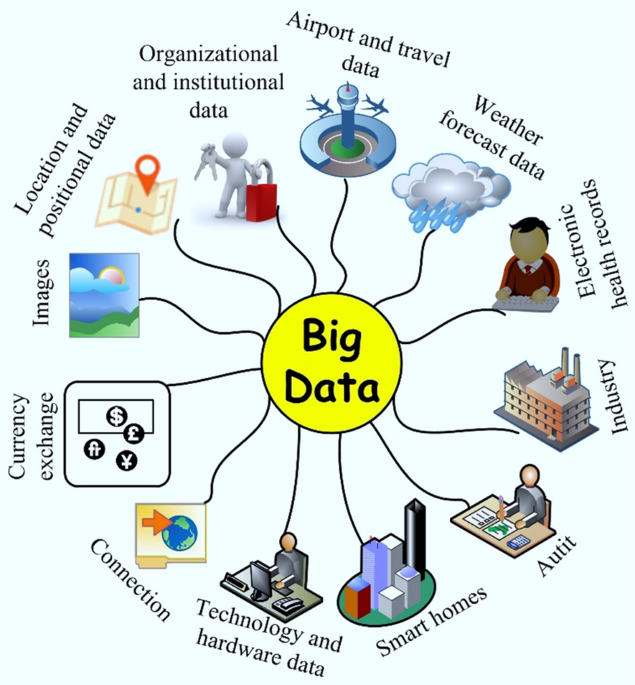

Cotiviti works with more than 180 payers to offer data analysis on payment accuracy, risk adjustment, quality improvement, patient engagement, and network and clinical analytics, according to the company’s website.

The healthcare analytics firm has been involved in other deal talks this year, according to media reports. In February, Bloomberg News reported that Carlyle Group was in talks to buy Cotiviti from Veritas Capital for up to $15 billion, including debt, citing sources familiar. But the purchase fell through in April.

Private equity dealmaking in healthcare services has slowed in 2023, according to reports by market research firm PitchBook. Deals were down 28% in the third quarter compared with the second quarter.

The average quarterly deal count is about half the height reached from late 2020 through mid-2022, when low interest rates encouraged mergers and acquisitions and firms could take advantage of growing cash reserves. But the lower average deal count still ranks above the pre-pandemic period from 2017 through early 2020, PitchBook noted.

KKR has been active in dealmaking this year, according to the WSJ. But one of its significant healthcare investments was wiped out when physician staffing firm Envision Healthcare filed for Chapter 11 bankruptcy this spring. The PE firm paid over $5 billion in 2018 to take Envision private, in a deal valued at $9.9 billion including debt.

Envision announced it had emerged from bankruptcy restructuring last month, splitting the company from its ambulatory surgery unit and reducing its debt load by more than 70%.

KKR did not comment on the potential deal. Cotiviti and Veritas Capital didn’t respond to requests for comment by press time.

This story was originally published on Healthcare Dive. To receive daily news and insights, subscribe to our free daily Healthcare Dive newsletter.

link